MONEY MARKET RATES

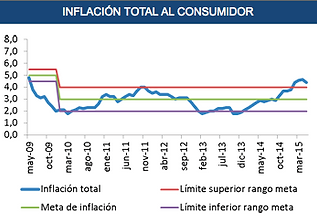

In first place, is important to understand the meaning of money market rates, that is an important part of the financial market, basically is credit operations are performed or traded short-term, this market have bonds, interbank market, and any financial asset market short term; In second place, in Colombia the "Monetary policy in Colombia is based on inflation targeting scheme whose purpose is to maintain a low and stable rate of inflation, and achieve output growth in line with the potential capacity of the economy"(taken of http://banrep.gov.co/es/politica-monetaria),the last year the money market rates it shows an increase of 3.66 percent, driven mainly by rising prices of food, education and housing.

Finally , in our company sector will be affected for monetary policy if inflation was not control because inflation produced to increased prices on products and services, for that reason, if the increased demand lower prices and if the lower the price of increased demand .

References (view on august 15, 2015):

http://www.banrep.gov.co/docum/Lectura_finanzas/pdf/junio_3.pdf

http://banrep.gov.co/es/politica-monetaria

https://www.citibank.com.co/resources/pdf/Cartilla_indices_bolsa_valores.pdf

http://www.portafolio.co/economia/inflacion-colombia-2014-0

FEDERAL GOVERNMENT BUDGET DEFICITS

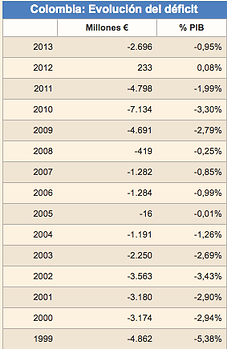

Now a days, in Colombia we are living a time of economic crisis due to the reduction of approximately 40% in the prices of oil in the world, for this reason analysts, specifically the finance minister, Mauricio Cardenas He said "Es el espacio que da la Regla Fiscal y se está cumpliendo a cabalidad con esta ley”, in the same way the minister explained that the deficit this year would be 3%, which would generate an increase in taxes to fill the void money that leaves this deficit, on the other hand the budget deficit in the current account would be around 6%; on the other hand the federal government deficit in 2014 was 2,41 of the Gross Domestic Product.

Finally, our sector of the economy could be affected, because if the government raises taxes on household spending would be reduced for this reason the Colombian families, specifically those of Bogota could stop spending on schools of football.

References (viewed on august 15, 2015):

http://datos.bancomundial.org/indicador/GC.BAL.CASH.GD.ZS/countries/1W-CO?display=graph

http://www.datosmacro.com/deficit/colombia

http://www.portafolio.co/economia/deficit-fiscal-colombia-2015-cardenas-ministerio-hacienda

s

x

GROSS DOMESTIC PRODUCT TREND

Gross domestic product has been reduced since the last year because Colombia economy is going through a difficult time, the GDP in 2014 was around 4.6%, but this year it is estimated that GDP will only grow by 2 , 7%, this statistic is based on the reduction that has taken over this year the price of oil.

finally, our sector of the economy could be affected, because the decline in GDP this year would reduce GDP per capita around the nation, consequently companies could be reduce the employment, for that reason the unemployment trend will be increase, on the other hand, spending of Colombians would be reduced and would be affected the income of football schools.

References (viewed on august 15, 2015):

http://www.portal.euromonitor.com.ezproxy.unisabana.edu.co/portal/statistics/tab

http://www.datosmacro.com/pib/colombia

CONSUMPTION PATTERNS

The consumption patterns of Colombians has been increased over time, as have potentially increased revenues due to the strengthening of the Colombian economy, but according to economic forecasts of the nation in 2015 the Colombian economy would be affected, on the other hand, experts say spending would be lower than 2014.

Finally, if the consumption patterns would be reduced, our sector will be afected because the colombian families dont spend so much in the different unnecessary services, like soccer schools.

References (Viewed on august 16, 2015):

http://www.portal.euromonitor.com.ezproxy.unisabana.edu.co/portal/statistics/tab

http://www.portafolio.co/columnistas/el-patron-produccion-y-consumo

http://www.dinero.com/economia/articulo/gasto-colombianos-durante-iii-trimestre/204341

UNEMPLOYMENT TRENDS

Throughout the years unemployment in Colombia has declined due to the different policies of the national government and the growth of the Colombian economy, in 2013 was evidenced that unemployment was around 10.5%, in 2014 was 9,1 %, and in this year b this budget reach to 9.3% because in April was evidenced that the figure reached 9.5%.

Finally, if the unemployment trend would be increased, our sector will be afected because the colombian families that are affected for this problem cant spend in the different unnecessary services, like soccer schools.

References (Viewed on august 16, 2015):

http://www.indexmundi.com/g/g.aspx?v=74&c=co&l=es

http://www.portal.euromonitor.com.ezproxy.unisabana.edu.co/portal/statistics/tab

http://datos.bancomundial.org/indicador/SL.UEM.TOTL.ZS/countries/1W-CO?display=graph

http://www.portafolio.co/economia/desempleo-colombia-abril-2015

http://www.portafolio.co/economia/tasa-desempleo-colombia-durante-2014-fue-91

PICTURE TAKEN FROM: http://databank.bancomundial.org/data/reports.aspx?Code=NY.GDP.MKTP.CD&id=af3ce82b&report_name=Popular_indicators&populartype=series&ispopular=y

PICTURE TAKEN FROM: http://www.portal.euromonitor.com.ezproxy.unisabana.edu.co/portal/statistics/tab

PICTURE TAKEN FROM: http://databank.bancomundial.org/data/reports.aspx?Code=NY.GDP.MKTP.CD&id=af3ce82b&report_name=Popular_indicators&populartype=series&ispopular=y

PICTURE TAKEN FROM: http://databank.bancomundial.org/data/reports.aspx?Code=NY.GDP.MKTP.CD&id=af3ce82b&report_name=Popular_indicators&populartype=series&ispopular=y

PICTURE TAKEN FROM: http://datos.bancomundial.org/indicador/SL.UEM.TOTL.ZS/countries/1W-CO?display=graph

PICTURE TAKEN FROM: http://www.indexmundi.com/g/g.aspx?v=74&c=co&l=es

PICTURE TAKEN FROM: http://databank.bancomundial.org/data/reports.aspx?Code=NY.GDP.MKTP.CD&id=af3ce82b&report_name=Popular_indicators&populartype=series&ispopular=y

Shift to a service economy

Now days the average income in the service economy in several countries is increasing in a very significant way. “A look at the largest employers shows how America’s economy has changed. Over the last 50 years, the country has shifted from creating good to providing services. Today, about tenth of the Americans work in manufacturing, while service providers and retailers like Wal-Mart and Temp firms like Kelly Services employ about six in seven of the nation´s workers”. (times)

"We aim to make Colombia a platform for exports of high value-added services to Colombian companies and other countries can, for example, open shared service centers and provide services to a potential market of more than eight hundred fifty million people". (ministerio de comercio, 2013)this argument by the Colombian minister Sergio Dias-Granados reinforces the fact that the economy is changing, because the employments that this sector is requiring are generating a high percent of the employment rate in the country as well as a high income for the companies. ”The service economy in developing countries is most often made up of the following industries: financial services, tourism, distribution, health, and education. (boundless)

this change in the way that economy is behaving, affects the sports sectors because the trend indicates that there is going to be a higher competence in the market.

Source

Boundless. . boundless.com. Retrieved from Gender roles and Differences: https://www.boundless.com/psychology/textbooks/boundless-psychology-textbook/gender-and-sexuality-15/introduction-to-gender-and-sexuality-75/gender-roles-and-differences-296-12831/

comercio, M. d. (2011, Febrero 2). Mincit. Retrieved from Gobierno y empresarios detectan 70 regulaciones que es necesario desmontar para una mayor competitividad: http://www.mincit.gov.co/publicaciones.php?id=1595

Availability of credit

For every economy or industry there are different types of financial options which are offered by the loaners in order to full fill the needs of the applicants.

There are special types of loans that are offered to developing business, with special benefits that help their clients to start a new business in the national territory, this credits are offered by different financial entities such as procredit bank, banco caja social, and many other national and foreign entities. (Emprende, 2015).

There are another type of financial entities that are more concerned about the type of business that they are providing the credit according to their interests. FOMIPYME suppor small and medium enterprices that are working on technological development, FONADE supports organizations that are going to generate employment in specific industries.

This research shows that medium and small enterprises in south America are being promoted by privet and governmental entities which are looking forward to reach an bilateral agreements with the PYMES in order to establish a mutual cooperation network.

Source

Emprende, B. (16 de february de 2015). Bogota Emprende. Recuperado el 16 agosto de 2015, de www.bogotaemprende.com.co: http://translate.google.com.co/translate?hl=en&sl=es&u=http://www.bogotaemprende.com/contenido/contenido.aspx%3FconID%3D4060%26catID%3D774&prev=search

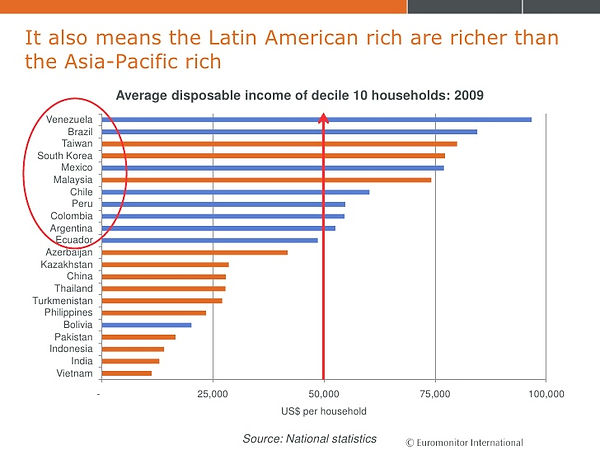

Level of disposable income

The level of disposable income is the main workforce of the economies, not only for its role in the management of capitals and resources but for the banking alternatives that very flexible in terms of the interest that entities have to pay, as well as the quantity of money they are loaning. (Colombia, 2012)

The disposable income is affected by the informal work rate shows that there is a difference between formal and informal workers. The informal employees often suffer from poor working conditions, they don’t have insurance, they are paid less than the minimum wages and the informal worker policies doesn’t give them any compensation for their labor. (Isabelle Journard, 2013).

the level of disposable income can vary between economic levels, showing that poor people have less chances of being hide for a formal job, this is why they take any working opportunity regardless the payment and conditions.

Source

Colombia, B. d. (october de 2012). www.bolsadevaloresdecolombia.com.co. Recuperado el 16 de agosto de 2015, de bolsa de valores de colombia: http://translate.google.com.co/translate?hl=en&sl=es&u=http://www.bvc.com.co/pps/tibco/portalbvc/Home/Mercados/Estudios_Tecnicos%3Fcom.tibco.ps.pagesvc.action%3DupdateRenderState%26rp.currentDocumentID%3D-8972d57_13cd3361e21_19f40a0a600b%26rp.attachmentPr

Isabelle Journard, J. L. (27 de marz de 2013). OECD Economics Department Working Paper. Recuperado el 16 de agosto de 2015, de OECD.library: Joumard, I. and J. Londoño Vélez (2013), “Income

propensity of people to spend

the Average Propensity to Consume (APC) refers to the percentage of income that is spent on goods and services, rather than on savings. One can determine the percentage of income spent by dividing the average households consumption, by the average household income. The inverse of the APC is the APS (average propensity to save). (INVESTOPEDIA)

According to the survey Money-Invamer Gallup, on average Colombian households spend $ 1'535.254 month. Half of these expenditures go to housing and food -in the same proportion-, followed by transport, education and recreation and fun. These results are consistent with those from the survey of households DANE (which is not done in the country since 1994, but will come on in the second half of this year) and allow to look closely at how consumers behave Colombians in different strata and what are the main trends. (dinero, 2004)

As a conclusion it can be said that the soccer club sector is being reflected in this economic variable because the Colombian population is used to spend some of their earning in fun, leisure and recreation.

Source

NVESTOPEDIA. (s.f.). investopeda. Recuperado el 16 de agosto de 2015, de investopedia: http://www.investopedia.com/terms/a/average-propensity-to-consume.asp

dinero. (08 de august de 2004). dinero. Recuperado el 16 de agosto de 2015, de www.dinero.com.co: http://translate.google.com.co/translate?hl=en&sl=es&u=http://www.dinero.com/caratula/edicion-impresa/articulo/en-gastan-colombianos/24478&prev=search

Interest rates

In Colombia and all over the world the tax rate are higly increasing because the price of the dollar has been increasing as well, this is why all type of loaners are using higher interests, because the fluctuation of the US Dollar is affecting their activities. commercialization activities between countries are also being affected by this economic variable.

Central Bank of Colombia decided to increase the benchmark interest rate by 25 bps to 4 percent. It is the third consecutive rate increase, aiming to contain inflationary pressures after a better than expected GDP growth rate in the first quarter. Policymakers also decided to increase its dollar purchases to bolster reserves and weaken the peso. (republica, 2014).

the changing interest rate is warning many industries because many of the PYMES are often using this type of loans, this is why the service industy directed to the recreation is also affected

Source

republica, b. d. (23 de june de 2014). trading economics. Recuperado el 16 de agosto de 2015, de www.tradingeconomics.com: http://www.tradingeconomics.com/colombia/interest-rate

Inflation rates

It is important to know that a stable inflation is very important for every country because this can determine the success or the failure on its economic targets. Since 1995 to 2015 the inflation rate in Colombia had a pick in 3.82 percent.

When a company is about to take a decision about any investment, loaning, they must have into account the value of money overt time, because the inflation can cause a mistake in the pricing of anything, so an investment could finish in loss for the company.

Such as the patrimony is one of the main credit of a enterprise, the investment on various entities could be highly affected and in the case of soccer club the affectation is going to be reflected in the investments of the company in all the equipment required for developing the company activities.

Source

Demand shifts for different categories of goods and services

The shift of the demand curve of a product or service, is caused by shifting trends or new competition, which can either lower or raise the price. (businessdictionary,2013)

So far in 2014 a variation of 3.38% was recorded. this rate is 1.71 percentage points higher than in the same period last year (1.67%). Between December 2013 and November 2014, ie the last twelve months, the CPI showed a variation of 3.65%. Four groups of goods and services had higher variations CPI for the month of November 2014: communications (0.61%); entertainment (0.53%); housing (0.19%) and others (0.15%). Meanwhile, five groups have lower CPI variations November 2014. These were clothing (0.10%); food (0.05%); transport (0.05%); education (0.01%) and health (0.01%). (Lopez, Sierra & Zárate, 2013)

In this sector we can se that one of the highest variations is entertaintment, this means that theindustry in wich soccer club is working on could be higly affected.

Source

Dictionary, B. (2004). bussines Dictionary. Retrieved from Product quality: http://www.businessdictionary.com/definition/product-quality.html

Income differences by region and consumer groups

Income is the engine that drives an economy because it is the only one who can create demand. Income means the highest amount of money that a single individual can spend .

Regional inequality is of interest for a variety of reasons: planning development policies aimed at alleviating poverty and reducing personal inequality, gauging the degree of a country's labor market integration, understanding patterns of population movement in general and labor force migration in particular, predicting future urbanization, and characterizing the poor. (Dane, 2013)

All over the national territory, there are diferent departments and cities that present a rally big diference between their incomes wich turns a into a big issue in terms of equiality.

Source

http://www.dane.gov.co/files/icer/2013/ICER_Bogota_Cundinamarca_2013.pdf

https://www.google.com.co/?client=safari&channel=mac_bm&gws_rd=cr&ei=8zXdVbO3DIG0eYjcs9gM

Price fluctuations

In Colombia the price fluctuation is really important, because it can determine wereas a product or servie is going to be successful or not, because in Colombia is the imcome doesn’t allow many sectors to spend in this type of services.

In effect, the consumer price index or CPI was 1.73% in the first 180 days of the year, down from the 2.01% recorded in the same period of 2012 This means that the behaviour of inflation remains under control and is in line with the goals of the Bank of the Republic, that this side does not see major threats even though the economy is growing at lower rates.(PAIS2013)

As the prices in in Colombia of goods and services decreased, it made easir for the Colombian community to purchase the type of services that are offered by the entertainment industry.

Source

republica, b. d. (23 de june de 2014). trading economics. Recuperado el 16 de agosto de 2015, de www.tradingeconomics.com: http://www.tradingeconomics.com/colombia/interest-rate

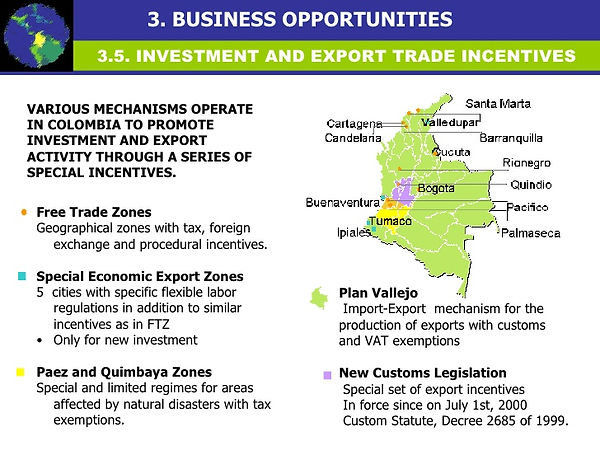

Export of labor and capital from Colombia

The exportation of workers and the investment in other coustries should represent an income for the country, because is common that the people who work out of the country send money to their families, and the investment should produce a revenue for the national companies.

3,331,107 Colombian citizens reside in other countries different from colombia,(dane 2013) and all of them represent an important part of the population that can work. Then the (Banco de la República de Colombia) stated that the capital flow was negative in 2014 meaning that more capital went out of the country that what entered, the exact number is 5068.38 USD million for the third quarter of the year.

This represents more of a disadvantage to our company because the capital that could be invested on us, is going outside the country to other investments, therefore indicators like FDI (foreign direct investment) are relevant to us to compensate this outflow of capital.

Source

republica, b. d. (23 de june de 2014). trading economics. Recuperado el 16 de agosto de 2015, de www.tradingeconomics.com: http://www.tradingeconomics.com/colombia/interest-rate

http://www.dane.gov.co/files/icer/2013/ICER_Bogota_Cundinamarca

Monetary policies

To achieve long term objectives and to maintain a law and stable inflation rate is the main objective of the monetary policy. According with the (Banco de la republica 2014) This is the only way to achieve sustained growth rates that will generate employment and improve the population’s quality of life. Otherwise, if the economy does not grow on a sustained basis, sooner or later a crisis will occur with serious consequences for the economy, leading to worsening social indicators, loss of public confidence, lowered investment and higher unemployment.

The monetary policies implemented by the Bank of Colombia has distinctly conservative cut, usually generate investment performance but with low profit margins, the policy focuses on controlling inflation in the nation, by changing interest rates on level of capital flows in the Colombian economy. (Banco de la republica, 2013)

This economic force show that foreign investors to buy and promote Colombian companies which could result in something positive for the economy, because the partnership represent mutual help.

Source

republica, b. d. (23 de june de 2014). trading economics. Recuperado el 16 de agosto de 2015, de www.tradingeconomics.com: http://www.tradingeconomics.com/colombia/interest-rate

http://www.dane.gov.co/files/icer/2013/ICER_Bogota_Cundinamarca

Worker productivity levels

Is the scale of hours that people work in an industry.

In Colombia the productivity level is too low, there are two factors, one is that in Colombia many people did not have a good study , for this reason people can not obtain capacities to improve their development. the other factor is that people use part of their time going back and forward between their homes and work place.

http://www.eltiempo.com/economia/sectores/baja-productividad-en-colombia-/14603116

Value of the dollar in world markets

During the last three months the value of the dollar in Colombia increased, It was at 2393 and now it is at 3003 Colombian pesos.

This value affects positively and negatively depending of the industry, for example it is positive for people who exports and negatively for people who import.

The value afect the industry because they need to import some implements to generate improvements for people that obtain their services.

http://www.banrep.gov.co/es/trm

Stock Market trends

It is where appear a tendency of the markets that shows the movement of the performance it takes growths or declines depend of the capacity of the employees.

In the industry affect depend of the salary that is going top ay for the employees that they are going to need.

http://www.scielo.org.co/scielo.php?script=sci_arttext&pid=S0120-35922010000100014

Foreign countries economic conditions

The economic condition its very important because it is the benefit of the administration of the country, its show how its governed this country in time ago, it is easy to see if a country is regulated and permanent in the economy.

http://www.economywatch.com/economic-conditions

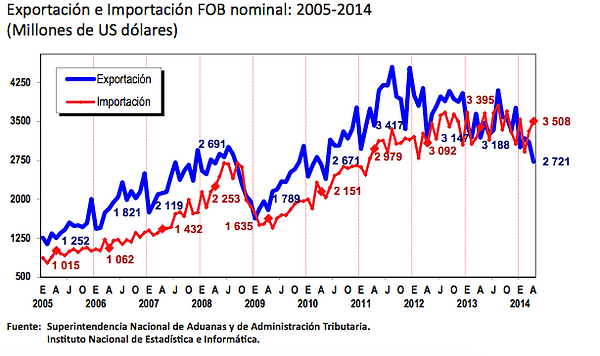

Import and Export Factors

At this Moments in Colombia it is affecting all the importing product to this country, the reason of this problem is that the value of the dollar is too high, for instead the exporting people are benefiting because the currency exchange help them and obtain more money per product that sale in other countries.

In the Industry at this moment affect a lot because all things that they need are products that people are importing and they are importing at the currency exchange of the dollar that is too high.

http://www.inei.gob.pe/media/MenuRecursivo/boletines/06_jun2014.pdf

ECONOMIC FORCES

"Economic factors have a direct impact on the potential attractiveness of various strategies."

Fiscal policies

Fiscal Policies is the public activity made by the government that regulates and controls macroeconomic variables such as the spending of government, government’s budget, tax rates, and the nation's debt. In Colombia, the fiscal policy concerns are to maintain an stable economy in terms of a regulated inflation, stable prices levels to customer in the market, also the to reach a low level of unemployment.

Tax rates

Every person or company has to pay contributions to the government, which refers to taxes. Taxes are revenue for the nation, but in the other hand is expenditure for consumers and enterprises. Saying that, there are two types of taxes the ones for business and the others for consumers. The payments of taxes are based on the incomes in the case of consumers and profits for companies. Thus, the more it’s owned the more it should be paid for taxes. Colombia has three kinds of tributes; they are divided into the national tax rate, the state tax rate, and the municipal tax rate. For the industry, there are certain types of taxes imposed to companies, and they are:

-

IVA: it is named “impuesto al valor agregado”. It’s understood that is collected by the firms but the tax goes through the business, and finally is paid by the consumer. Ususally is contribution is 16% of the product or services.

-

Renta: refers to the tax imposed based on the income (Income tax), which contributes with the 25% of the company’s income.

-

CREE: this tax is based on the patrimony (patrimony tax) and it takes 9% of the increments in the patrimony.

-

ICA: municipal tax.

-

Retefuente

-

http://datos.bancomundial.org/indicador/IC.TAX.TOTL.CP.ZS/countries/1W-CO?display=graph

-

http://datos.bancomundial.org/indicador/IC.TAX.PAYM/countries/1W-CO?display=graph

European Economic Community (EEC) policies

The European Economic Community (EEC) was established in 1958 by the European Community (EC), as a result of the previous signed treaties such as the European Coal and Steel Community (ECSC) and the European Atomic Energy Community.This organization has achieved really important objectives like a set up free trade area, where are remove all barriers to trade between member countries.Some of their policies have improved and developed the market in terms of profit for the companies, and a stable prices and high quality products for customers.Furthermore, the impact of some their intentions has lead to implementation of a common market and customs union. In order to that, the EU has also developed some common policies to contribute to the cause.

-

http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=URISERV:xy0023

-

http://www.econlib.org/library/Enc1/EuropeanEconomicCommunity.html

-

http://europa.eu/pol/emu/index_en.htm Organization of Petroleum Exporting Countries (OPEC) policies

The Organization of Petroleum Exporting Countries (OPEC) policies